Ukrayna ve Türkiye arasında Serbest Ticaret Anlaşması Ukraynaca, Türkçe ve İngilizce metinlerle 3 Şubat 2022’de Kiev’de imzalandı. Yorum farklılıkları olması durumunda geçerli olacak ve Ukrayna Ekonomi Bakanlığı tarafından yayınlanan İngilizce metni paylaşıyoruz.

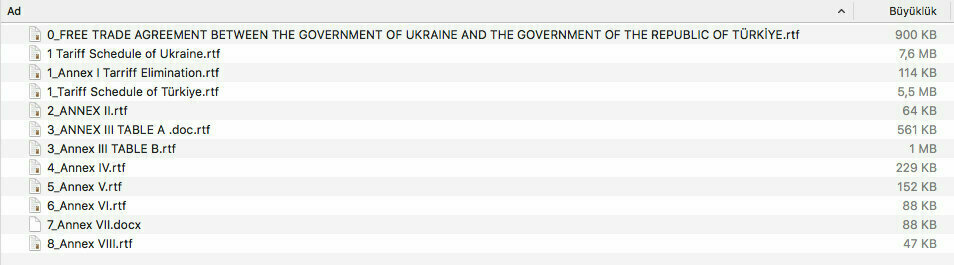

Aşağıdaki belirtilen dosyaları sıkıştırılmış tek dosya olarak Ukrayna Ekonomi Bakanlığı’nın sitesinden indirebilirsiniz. Metnin Türkçe versiyonuna henüz ulaşamadık. Yayınlandığı zaman burada link vereceğiz.

FREE TRADE AGREEMENT BETWEEN THE GOVERNMENT OF UKRAINE AND THE GOVERNMENT OF THE REPUBLIC OF TÜRKİYE

TABLE OF CONTENTS

PREAMBLE

TITLE I INITIAL PROVISIONS

Article I.1 Objectives

Article I.2 Relation to Other Agreements

Article I.3 Customs Union and Free Trade Areas

Article I.4 Definitions

TITLE II MARKET ACCESS FOR GOODS

Chapter 1 COMMON PROVISIONS

Article II.1 National Treatment on Internal Taxation and Regulations

Article II.2 Objective

Article II.3 Classification and Valuation of Goods

Article II.4 Customs Duty

Article II.5 Rules of Origin

Article II.6 Import and Export Restrictions

Article II.7 Fees and Other Charges

Article II.8 Data sharing on preference utilization

Article II.9 Export subsidies and measures of equivalent effect

Article II.10 Freedom of Transit

Article II.11 State Trading Enterprises

Chapter 2 CUSTOMS DUTIES

Article II.12 Scope

Article II.13 Customs Duties on Imports

Article II.14 Customs Duties on Exports and Charges Having Equivalent Effect

Article II.15 Administration and Implementation of Tariff-Rate Quotas

TITLE III OTHER TRADE RELATED PROVISIONS

Article III.1 Sanitary and Phytosanitary Measures

Article III.2 Technical Barriers to Trade

Article III.3 Bilateral Safeguard Measures

Article III.4 Global Safeguard Measure

Article III.5 Antidumping and Countervailing Measures

Article III.6 Intellectual Property

Article III.7 Trade Facilitation

Article III.8 Customs Cooperation

TITLE IV TRADE IN SERVICES

Article IV.1 Scope and Coverage

Article IV.2 Incorporation of Provisions from the GATS

Article IV.3 Definitions

Article IV.4 Most-Favoured-Nation Treatment

Article IV.5 Market Access

Article IV.6 National Treatment

Article IV.7 Additional Commitments

Article IV.8 Domestic Regulation

Article IV.9 Mutual Recognition

Article IV.10 Transparency and Disclosure of Confidential Information

Article IV.11 Monopolies and Exclusive Service Suppliers

Article IV.12 Business Practices

Article IV.13 Payments and Transfers

Article IV.14 Restrictions to Safeguard the Balance of Payments

Article IV.15 Schedules of Specific Commitments

Article IV.16 Modification of Schedules

Article IV.17 Review of Commitments

Article IV.18 Emergency Safeguard Measures

Article IV.19 Denial of Benefits

Article IV.20 Annexes

TITLE V FACILITATION OF COMMERCIAL PRESENCE

Article V.1 Objectives and Scope

Article V.2 Definitions

Article V.3 Transparency and Predictability

Article V.4 Procedures

Article V.5 Fees

Article V.6 Appeal and Review

Article V.7 Independence and Impartiality

Article V.8 Digitalization and Electronic Governance

Article V.9 Movement of Business Persons

Article V.10 Working Group on Facilitation of Activities Through Commercial Presence

TITLE VI ELECTRONIC COMMERCE

Article VI.1 Objective

Article VI. 2 Scope and Definitions

Article VI.3 Supply of Services through Electronic Means

Article VI.4 Personal Data Protection

Article VI.5 Electronic Authentication and Electronic Signatures

Article VI.6 Online Consumer Protection

Article VI.7 Unsolicited Commercial Electronic Messages

Article VI.8 Co-operation on Regulatory Issues

TITLE VII COMPETITION

Article VII.1 Rules of Competition concerning Undertakings, State Aid

TITLE VIII DISPUTE SETTLEMENT

Article VIII.1 Scope and Coverage

Article VIII.2 Good Offices, Conciliation or Mediation

Article VIII.3 Consultations

Article VIII.4 Establishment of an Arbitration Panel

Article VIII.5 Roster for the Arbitration Panel

Article VIII.6 Composition of the Arbitration Panel

Article VIII.7 Terms of Reference

Article VIII.8 Procedures of the Arbitration Panel

Article VIII.9 Arbitration Panel Reports

Article VIII.10 Suspension or Termination of Arbitration Panel Proceedings

Article VIII.11 Implementation of the Final Report

Article VIII.12 Compensation and Suspension of Benefits

ArticleVIII.13 Other Provisions

TITLE IX TRANSPARENCY, INSTITUTIONAL PROVISIONS, EXCEPTIONS AND FINAL PROVISIONS

Article IX.1 Transparency

Article IX.2 General and Security Exceptions

Article IX.3 Balance of Payments

Article IX.4 Establishment of the Joint Committee

Article IX.5 Procedures of the Joint Committee

Article IX.6 Fulfilment of Obligations

Article IX.7 Annexes

Article IX.8 Amendments

Article IX.9 Validity and Withdrawal

Article IX.10 Review and further negotiations

Article IX.11 Entry into Force

ANNEX I (Tariff Elimination)

Table A Tariff Schedule of Ukraine

Table B Tariff Schedule of Türkiye

ANNEX II (Exceptions to the Article II.14 Customs Duties on Export and Charges Having Equivalent Effect)

ANNEX III SCHEDULES OF SPECIFIC COMMITMENTS AND LISTS OF MFN EXEMPTIONS

TABLE A UKRAINE – SCHEDULE OF SPECIFIC COMMITMENTS AND LIST OF MFN EXEMPTIONS

TABLE B TÜRKİYE – SCHEDULE OF SPECIFIC COMMITMENTS AND LIST OF MFN EXEMPTIONS

ANNEX IV FINANCIAL SERVICES

ANNEX V TRANSPORT AND LOGISTICS SERVICES

ANNEX VI MOVEMENT OF NATURAL PERSONS

ANNEX VII TELECOMMUNICATIONS SERVICES

ANNEX VIII JOINT DECLARATION ON THE RULES OF ORIGIN

PREAMBLE

The Government of Ukraine and the Government of the Republic of Türkiye (hereinafter referred to as “the Parties” or “Ukraine” and “Türkiye” where appropriate)

WILLING to develop and strengthen friendly relations, especially in the fields of economic co-operation and trade, with an aim to contribute to the progress of economic co-operation between the Parties and to increase the scope of mutual trade exchange;

CONFIRMING their intention to participate actively in the process of economic integration in Europe expressing their preparedness to co-operate in seeking ways and means to strengthen this process;

TAKING INTO CONSIDERATION the “Agreement Establishing an Association between the Republic of Turkey and the European Economic Community” and the Association Agreement between the European Union and its Member States, of the one part, and Ukraine, of the other part;

HAVING regard to the experience gained from the co-operation developed between the Parties as well as between them and their main trading partners;

DECLARING their readiness to undertake activities with a view to promoting harmonious development of their trade as well as to expanding and diversifying their mutual co-operation in the fields of joint interest, including fields not covered by this Agreement, thus creating a framework and supportive environment based on equality, non discrimination, and a balance of rights and obligations;

DESIRING to raise living standards, promote economic growth and stability, create new employment opportunities and improve the general welfare by liberalising and expanding mutual trade;

REFERRING to the mutual interest of the Parties in the continual reinforcement of the multilateral trading system and considering that the provisions of the General Agreement on Tariffs and Trade 1994 (hereinafter “GATT 1994”) and the World Trade Organization (hereinafter “WTO”) constitute a basis for their foreign trade policy;

RESOLVED to lay down for this purpose provisions aimed at the progressive abolition of the obstacles to trade between the Parties in accordance with the provisions of these instruments, in particular those concerning the establishment of free trade areas;

RECOGNISING the importance of trade facilitation in promoting efficient and transparent procedures to reduce costs and to ensure predictability for the trading communities of the Parties;

STRESSING the importance of transparency in international trade to the benefit of all stakeholders;

HAVE DECIDED, in pursuance of these objectives, to conclude the following Agreement (hereinafter referred to as “this Agreement”).

TITLE I

INITIAL PROVISIONS

Article I.1 Objectives

- The Parties hereby establish a free trade area by means of this Agreement and in conformity with the WTO rules.

- The objectives of this Agreement are:

- to increase and enhance the economic cooperation between the Parties and raise the living standard of their people,

- to gradually eliminate difficulties and restrictions on trade in goods and to progressively liberalize trade in services,

- to promote, through the expansion of reciprocal trade, the harmonious development of the economic relations between the Parties,

- to contribute by the removal of barriers to trade, to the harmonious development and expansion of world trade,

- to promote bilateral trade and

- to provide fair conditions of competition in trade between the Parties.

Article I.2 Relation to Other Agreements

1. This Agreement shall in no way prejudice the obligation of the Parties arising from their participation in the regional or sub-regional unions and entities, and multilateral treaties as well as in international organizations.

2. The rights and obligations arising from treaties concluded between the Parties before or after entry into force of this Agreement shall not be affected by the provisions of this Agreement.

Article I.3 Customs Union and Free Trade Areas

1. This Agreement shall not preclude the maintenance or establishment of customs unions, free trade areas, arrangements for frontier trade and other preferential agreements insofar as they do not have the effect of altering the trade arrangements provided for in this Agreement.

2. When a Party enters into a customs union or free trade agreement with a third party, it shall, upon request by other Party, be prepared to enter into consultations with the requesting Party.

Article I.4 Definitions

For purposes of this Agreement, unless otherwise specified further, the definitions of WTO are applicable to this Agreement mutatis mutandis.

Agreement means the Free Trade Agreement between the Government of the Republic of Türkiye and the Government of Ukraine;

customs authority or customs authorities means:

- for Türkiye, the Ministry of Trade, or its successor;

- for Ukraine, State Customs Service of Ukraine or its successor;

customs value means the value as determined in accordance with the Agreement on Implementation of Article VII of the GATT 1994, contained in Annex 1A to the WTO Agreement;

day means calendar day, including weekends and holidays;

enterprise means any entity constituted or organised under applicable law, whether or not for profit, and whether privately or publicly-owned or controlled, including any corporation, trust, partnership, sole proprietorship, joint venture, or similar organisation;

Harmonized System (HS) means the Harmonized Commodity Description and Coding System, including its General Rules of Interpretation, Section Notes and Chapter Notes, and its subsequent amendments, as adopted and implemented by the Parties in their respective tariff laws

measure includes a law, regulation, rule, procedure, decision, administrative action, requirement, practice or any other form of measure by a Party;

originating has the meaning given in the Article II.5;

person unless the context otherwise requires, includes natural and juridical persons;

territory means:

a) in respect of the Republic of Türkiye: the land territory, internal waters, the territorial sea and the airspace above them, as well as the maritime areas over which Türkiye has sovereign rights or jurisdiction for the purpose of exploration, exploitation and preservation of natural resources whether living or non-living, pursuant to international law.

b) in respect of Ukraine: the land territory, internal waters, territorial waters and airspace above them, the exclusive economic zone and continental shelf beyond the territorial waters in respect of which it exercises jurisdiction, sovereign rights in accordance with the applicable national and international law.

This Agreement shall not apply over territories, which are integral parts of the territory of Ukraine, but remain under foreign occupation until Ukraine regains full and effective control over them.

WCO means the World Customs Organization;

WTO Agreement means the Marrakesh Agreement establishing World Trade Organization, done at Marrakesh, 15 April 1994.

TITLE II

MARKET ACCESS FOR GOODS

Chapter 1 Common Provisions

Article II.1 National Treatment on Internal Taxation and Regulations

Each Party shall accord National Treatment to the goods of the other Party in accordance with Article III of the GATT 1994, including its interpretative notes; and to this end, Article III of GATT 1994, and its interpretative notes are incorporated into and made part of this Agreement, mutatis mutandis.

Article II.2 Objective

The Parties shall gradually liberalise substantially trade in goods between them over a transitional period starting from the date of entry into force of this Agreement, in accordance with this Agreement and in conformity with Article XXIV of GATT 1994.

Article II.3 Classification and Valuation of Goods

- The classification of goods in trade between the Parties shall be that set out in each Party’s respective tariff nomenclature in conformity with the Harmonized Commodity Description and Coding System (hereinafter referred to as “the Harmonized System” or “HS”).

- The Parties shall determine the customs value of goods traded between them in accordance with the provisions of Article VII of the GATT 1994 and the WTO Agreement on Implementation of Article VII of the GATT 1994.

Article II.4 Customs Duty

A customs duty includes any duty or charge of equivalent effect imposed in connection with the importation or exportation of goods, including any form of surtax or surcharge in connection with such importation or exportation, but does not include any:

- internal taxes or other internal charges imposed consistently with Article II.1;

- antidumping or countervailing duties applied consistently with Article III.5; and

- fees or other charges imposed consistently with Article II.7.

Article II.5 Rules of Origin

1. For the purpose of implementing this Agreement, Appendix I and the relevant provisions of Appendix II to the Regional Convention on pan-Euro-Mediterranean preferential rules of origin («the Convention»), as it may be subsequently amended, shall apply and are hereby incorporated into and made part of the Agreement, mutatis mutandis.

All references to the ‘relevant agreement’ in Appendix I and in the relevant provisions of Appendix II to the Convention shall be construed so as to mean this Agreement.

2. Until the application of the revised rules of the PEM Convention and notwithstanding Articles 16(5) and 21(3) of Appendix I to the Convention, where cumulation involves only EFTA States, the Faroe Islands, the European Union, Türkiye, the participants in the Stabilization and Association Process, the Republic of Moldova, Georgia and Ukraine, the proof of origin may be a movement certificate EUR.1 or an origin declaration.

3. As an alternative to the provisions regarding the issuance of movement certificates, the Parties shall accept electronically issued movement certificates EUR.1. The customs authorities of the exporting and the importing Party shall agree on formal requirements of electronically issued movement certificates EUR.1.

Each exporting Party shall inform the Joint Committee of this Agreement about the readiness of the issuance of electronic movement certificates EUR.1 and all technical issues related to such implementation (issuance, submission and verification of an electronic certificate).

If agreed by the customs authorities of the exporting and importing Parties, paragraphs 1 and 2 of Annex IIIa to the Convention shall not apply if the movement certificate is issued and validated electronically.

4. Where disputes arise in relation to the verification procedures of Article 32 of Appendix I to the Convention that cannot be settled between the customs authorities requesting the verification and the customs authorities responsible for carrying out this verification, they shall be submitted to the Joint Committee provided for in Article IX.4 of this Agreement.

In all cases, the settlement of disputes between the importer and the customs authorities of the importing Party shall take place under the legislation of that country.

5. If Ukraine or Türkiye notifies the depositary in writing of their intention to withdraw from the Convention in accordance with its Article 9, Ukraine and Türkiye shall immediately enter into negotiations within the framework of the Joint Committee on the introduction of new rules for the determination of the origin for the purpose of this Agreement.

6. Until the entry into force of such new mutually agreed rules of origin, the Parties shall apply the rules of origin contained in Appendix I and, where applicable, in Appendix II of the Convention allowing for the use of bilateral cumulation exclusively between the Parties.

Article II.6 Import and Export Restrictions

The rights and obligations of the Parties in respect of export and import restrictions shall be governed by Article XI of the GATT 1994, which is hereby incorporated into and made part of this Agreement.

Article II.7 Fees and Other Charges

Each Party shall ensure, in accordance with Article VIII of the GATT 1994 and its interpretative notes, that all fees and charges of whatever character (other than customs duties, charges equivalent to an internal tax or other internal charges, applied consistently with Article III paragraph 2 of the GATT 1994, and antidumping and countervailing duties) imposed on or in connection with importation or exportation are limited in amount to the approximate cost of services rendered and do not represent an indirect protection to domestic goods or a taxation of imports or exports for fiscal purposes.

Article II.8 Data sharing on preference utilization

1. For the purposes of monitoring the functioning of this Agreement and calculating preference utilization rates and tariff rates quotas, Parties shall, upon the request of a Party, exchange import statistics starting one year after the entry into force of this Agreement. The Joint Committee may review the process and content of this data exchange.

2. The exchange of import statistics shall cover data pertaining to the most recent year available, including value and, where applicable, volume, at the tariff line level for imports of goods of the other Party benefitting from preferential duty treatment under this Agreement and those that received non-preferential treatment.

Article II.9 Export subsidies and measures of equivalent effect

1. For the purposes of this Article, “export subsidies” shall have the meaning assigned to that term in Article 1 (e) of the WTO Agreement on Agriculture, including any amendment of that Article.

2. Upon entry into force of this Agreement, no Party shall maintain, introduce or reintroduce export subsidies or other measures with equivalent effect on agricultural goods destined to the territory of the other Party.

Article II.10 Freedom of Transit

The Parties shall ensure free transit traffic, originating in the territory of the State of one Party and transporting through the territory of the State of the other Party, in accordance with Article V of GATT 1994.

Article II.11 State Trading Enterprises

The rights and obligations of the Parties in respect of state trading enterprises shall be governed by Article XVII of the GATT 1994 and the Understanding on the Interpretation of Article XVII of the GATT 1994, which are hereby incorporated into and made part of this Agreement.

CHAPTER 2

reductıon and/or Elimination of Customs Duties

Article II.12 Scope

1.The provisions of this Chapter shall apply to the goods falling within Chapters 01 to 97 of the Harmonised System originating in the territory of the Parties.

2. In accordance with the schedules in Annex I, the excluded goods and goods in which tariff-rate quota is established, out of the quotas shall not be within the scope as defined in the first paragraph of this Article. Türkiye undertakes not to apply additional customs duties for the industrial and processed agricultural products falling under the scope of the Decision No 1/95 of the EC-Turkey Association Council Decision.

Article II.13 Customs Duties on Imports

- Except as otherwise provided in this Agreement, each Party shall reduce or eliminate its customs duties on originating goods of the other Party in accordance with its Schedule included in Annex I.

- The base rate of customs duties on imports, to which the successive reductions are to be applied under paragraph 1, shall be the most-favoured-nation (hereinafter referred to as the “MFN”) rate of customs duty applied on 1 January 2012 that specified in the Schedules in Annex I.

- If, at any moment, a Party reduces its applied MFN customs duty rates on imports after the date of entry into force of this Agreement, that duty rate shall apply if and for as long as it is lower than the customs duty rate on imports calculated in accordance with its Schedule in Annex I.

- Reduced duties calculated in accordance with paragraph 1 of this Article shall be rounded to the first decimal place or, in the case of specific duties, to the second decimal place using common arithmetical principles.

- As indicated in the Annex I, the Parties shall abolish any charges having an equivalent effect to customs duties in trade between themselves on imports of goods originating in Türkiye or in Ukraine upon the entry into force of this Agreement.

Article II.14 Exports Duties and Charges Having Equivalent Effect

Except as otherwise provided in Annex II, each Party may apply duties, taxes or charges having equivalent effect, on exports, in accordance with their rights and obligations under the WTO.

Article II.15 Administration and Implementation of Tariff-Rate Quotas

- Each Party shall implement and administer the tariff-rate quotas (TRQs) set out in Annex I in accordance to Article XIII of the GATT 1994, including its interpretive notes.

- Except as otherwise provided in this Agreement, each Party shall ensure that:

- its procedures for administering its TRQs are transparent, made available to the public, timely, non-discriminatory, responsive to market conditions, and minimally burdensome to trade;

- every effort is made to administer its TRQ in a manner that facilitates trade and allows Parties to fully utilize it;

- any person of the Parties that fulfills Parties’ legal and administrative requirements shall be eligible to utilize Parties’ TRQ; and,

- the TRQ is administered exclusively by its government authorities, and that this administration is not delegated to another person.

- In year one, the applicable annual quantities shall be made available proportionally starting on the date this Agreement enters into force until December 31 of the same year. From year two and in each subsequent year, the applicable annual quantities shall be made available from January 1 until December 31 of each calendar year.

- No Party may condition application for, or use of, an in-quota quantity allocation under a TRQ on the re-export of a good.

- For the purpose of administration of tariff rate quotas, the Parties shall include into the calculation of volume of import under tariff rate quotas only the goods imported to the Parties under customs procedure defined in Specific Annex B to Revised Kyoto Convention.

The Parties shall take necessary measures that good placed for customs clearance under other custom procedures, defined in Revised Kyoto Convention, shall not be included into the calculation of usage of tariff rate quotas under this Agreement, in particular goods under custom procedures, defined in Specific Annex F to Revised Kyoto Convention.

- During the course of each year, the administering authority of the Parties shall publish, in a timely and ongoing fashion on its designated publicly available internet site, administration procedures, utilization rates, and remaining available quantities for the TRQ established under this Agreement.

TITLE III

OTHER TRADE RELATED PROVISIONS

Article III.1 Sanitary and Phytosanitary Measures

1. The rights and obligations of the Parties in respect of sanitary and phytosanitary measures shall be governed by the WTO Agreement on the Application of Sanitary and Phytosanitary Measures (hereinafter referred to as “the SPS Agreement”).

2. The Parties shall exchange names and addresses of contact points with sanitary and phytosanitary expertise in order to facilitate communication and exchange of information.

Article III.2 Technical Barriers to Trade

1. The rights and obligations of the Parties in respect of technical regulations, standards and conformity assessment shall be governed by the WTO Agreement on Technical Barriers to Trade (hereinafter referred to as “the TBT Agreement”).

2. Without prejudice to paragraph 1, the Parties agree to hold consultations where a Party considers that the other Party has taken measures not in conformity with the TBT Agreement which are likely to create, or have created, an obstacle to trade, in order to find an appropriate solution in conformity with the TBT Agreement.

3. The Parties shall cooperate and exchange information within the Joint Committee in the fields of technical regulations, standards, metrology, conformity assessment, accreditation and market surveillance procedures, with the aim of eliminating technical barriers to trade.

4. Each Party, upon a request from the other Party, shall submit information on particular individual cases of technical regulations, standards, technical rules or similar measures.

5. Each Party shall, upon the entry into force of this Agreement, designate a contact point for the implementation of this Article and notify the other Party of the contact details including information regarding the relevant officials.

6. Simultaneously with the commencement of the negotiations between the EU-Ukraine on the Agreement on Conformity Assessment and Acceptance of Industrial Products (ACAA), the Parties shall initiate negotiations on a mutual recognition agreement (MRA) in accordance with the scope of the EU – Ukraine ACAA.

Article III.3 Bilateral Safeguard Measures

1. Where, as a result of the reduction or elimination of a customs duty under this Agreement, originating goods of a Party are being imported into the territory of another Party in such increased quantities, in absolute terms or relative to domestic production, and under such conditions as to cause or threaten to cause serious injury to the domestic industry of like or directly competitive products in the territory of the importing Party, the importing Party may take bilateral safeguard measures to the minimum extent necessary to remedy or prevent the injury, subject to the provisions of paragraphs 2 to 11 of this Article.

2. Bilateral safeguard measures shall only be taken upon clear evidence that increased imports have caused or are threatening to cause serious injury pursuant to an investigation in accordance with the procedures laid down in Articles 3 and 4 of the WTO Agreement on Safeguards. To this end, Articles 3 and 4 of the WTO Agreement on Safeguards are incorporated into and made part of this Agreement, mutatis mutandis.

3. The Party intending to take a bilateral safeguard measure under this Article shall immediately, and in any case before taking a measure, make written notification to the other Party. The notification shall contain all pertinent information, which shall include evidence of serious injury or threat thereof caused by increased imports, a precise description of the product involved and the proposed measure, as well as the proposed date of introduction, expected duration and timetable for the progressive removal of the measure.

4. If the conditions set out in paragraph 1 of this Article are met, the importing Party may take measures consisting in increasing the rate of customs duty for the product to a level not to exceed the lesser of:

- the MFN rate of customs duty applied at the time the action is taken; and

- the base rate of customs duty specified in Annex I.

5. Bilateral safeguard measures shall be taken for a period not exceeding two years. In very exceptional circumstances, after review by the Joint Committee, measures may be taken up to a total maximum period of three years. No bilateral safeguard measures shall be applied to the import of a product which has previously been subject to such a measure.

6. Any provisional bilateral safeguard measure shall be terminated within 200 days at the latest. The period of application of any such provisional bilateral safeguard measure shall be counted as part of the duration of the bilateral safeguard measure set out in paragraph 5 of this Article and any extension thereof. Any revenues collected after tariff increases shall be promptly refunded if the investigation described in paragraph 2 of this Article does not result in a finding that the conditions of paragraph 1 are met.

7. The Joint Committee shall, within 30 days from the date of notification, examine the information provided under paragraph 3 of this Article in order to facilitate a mutually acceptable resolution of the matter. In the absence of such resolution, the importing Party may adopt a measure pursuant to paragraph 4 of this Article to remedy the problem, and, in the absence of mutually agreed compensation, the Party against whose product the measure is taken may take compensatory action. In the selection of the bilateral safeguard measure and the compensatory action, priority must be given to the measure which least disturbs the functioning of this Agreement. The compensatory action shall normally consist of suspension of concessions having substantially equivalent trade effects or concessions substantially equivalent to the value of the additional duties expected to result from the bilateral safeguard measure. The Party taking compensatory action shall apply the action only for the minimum period necessary to achieve the substantially equivalent trade effects and in any event, only while the bilateral safeguard measure under paragraph 4 of this Article is being applied.

8. Upon the termination of the bilateral safeguard measure, the rate of customs duty shall be the rate which would have been in effect if the measure had not been applied.

9. In critical circumstances, where delay in the introduction of a bilateral safeguard measure in accordance with this Article would cause damage which would be difficult to repair, a Party may take a provisional bilateral safeguard measure pursuant to a preliminary determination that there is clear evidence that increased imports as to cause or threaten to cause serious injury to the domestic industry. The Party intending to take such a measure shall immediately notify the other Party. Within 30 days of the date of the notification, the procedures set out in paragraphs 2 to 6 of this Article, including for compensatory action, shall be initiated. Any compensation shall be based on the total period of application of the provisional bilateral safeguard measure and of the bilateral safeguard measure.

- Five years after the date of entry into force of this Agreement, the Parties shall review in the Joint Committee whether there is need to maintain the possibility to take bilateral safeguard measures between them. If the Parties decide, after the first review, to maintain such possibility, they shall thereafter conduct biennial reviews of this matter in the Joint Committee.

- Documents submitted to the investigating authorities could be in English besides the official language of the investigating Party.

Article III.4 Global Safeguard Measure

1. If a product is being imported, irrespective of its origin, in such increased quantities, absolute or relative to domestic production, and under such conditions as to cause or threaten to cause serious injury to the domestic industry that produces like or directly competitive products each Party has a right to apply safeguard measures to such products according to Article XIX of the GATT 1994 and WTO Agreement on Safeguards. To this end, Article XIX of the GATT 1994 and the WTO Agreement on Safeguards are incorporated into and made part of this Agreement, mutatis mutandis.

2. At the request of the other Party and/or provided that it has a substantial interest, the Party intending to take safeguard measures shall provide immediately ad hoc written notification of all pertinent information on the initiation of the safeguard investigation, the provisional findings and the final findings of the investigation.

3. For the purpose of this Article, it is considered that a Party has a substantial interest when it is among the five largest suppliers of the imported goods during the most recent three-year period of time, measured in terms of either absolute volume or value.

4. Neither Party shall apply, with respect to the same good, at the same time:

- a bilateral safeguard measure in accordance with Article III.3, and

- a measure under Article XIX of the GATT 1994 and the WTO Agreement on Safeguards.

5. Dispute Settlement under Title VIII shall not apply to this Article.

Article III.5 Antidumping and Countervailing Measures

- Both Parties agree that anti-dumping and countervailing measures should be applied in full compliance with Article VI of the GATT 1994, the Agreement on Implementation of Article VI of the GATT 1994 (WTO Anti-Dumping Agreement) and WTO Agreement on Subsidies and Countervailing Measures and should be based on a fair and transparent system.

- Türkiye reaffirms the market economy status of Ukraine for the purposes of antidumping investigations.

3. Immediately after any imposition of provisional measures and before the final decision is taken, the Parties shall ensure disclosure of all essential facts and considerations which form the basis for the decision to apply these measures in sufficient detail. Disclosures shall be made in writing and allow interested parties sufficient time to respond with comments. After final disclosure interested parties shall be given at least ten days to make these comments. Each interested party shall be granted the possibility to express their views during an anti-dumping investigation.

4. Should a Party decide to impose an anti-dumping duty, the amount of such duty shall not exceed the margin of dumping and should be less than the margin if such a lesser duty is adequate to remove the injury to the domestic industry.

5. Dispute Settlement under Title VIII shall not apply to this Article.

Article III.6 Intellectual Property

- The Parties recognize the importance of the protection and enforcement of intellectual property rights in promoting economic and social development, technological innovation and the transfer and dissemination of technology to the mutual advantage of technology producers and users.

- The Parties reaffirm their existing rights and obligations with respect to each other under the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (hereinafter referred to as “the TRIPS Agreement”) and any other multilateral intellectual property rights agreements to which both are party.

- Nothing in this Article shall prevent a Party from adopting appropriate measures to prevent:

- the abuse of intellectual property rights by right holders or the resort to practices that unreasonably restrain trade or adversely affect the international transfer of technology; and

- anti-competitive practices that may result from the abuse of intellectual property rights

provided that such measures are consistent with this Agreement.

- The Parties shall provide the legal means for interested parties to prevent commercial use of country names of the other Party in relation to goods in a manner which is likely to mislead consumers as to the origin of such goods.

- Consistent with paragraph 1, the Parties agree to cooperate with each other. Such cooperation may include, inter alia:

- notification of contact points;

- exchange of information regarding the intellectual property rights systems, aimed at promoting the efficient registration of intellectual property rights;

- other activities and initiatives as may be mutually determined between the Parties.

Article III.7 Trade Facilitation

To facilitate trade between Türkiye and Ukraine, the Parties shall:

- simplify, to the greatest extent possible, procedures for trade in goods in accordance with their respective commitments under the WTO Trade Facilitation Agreement;

- promote the cooperation of the Parties in multilateral fora in order to enhance their participation in the development and implementation of international conventions and recommendations on trade facilitation; and

- cooperate on trade facilitation within the framework of the Joint Committee.

Article III.8 Customs Cooperation

- The Parties shall continue to cooperate on Customs matters within the scope of the “Agreement between the Government of the Republic of Turkey and the Government of Ukraine Regarding Mutual Assistance in Customs Matters” signed 27 November 1996.

- For the purposes of paragraph 1 of this Article and of facilitating legitimate trade and combating cross-border crime,

- The Parties shall, within their own initiative or on request, assist each other to ensure the correct application of customs legislation within their competence and in accordance with their domestic law and regulations,

- Assistance in customs matters shall apply to any administrative authority of the Parties, which is competent. It shall not prejudice the rules governing mutual assistance in criminal matters.

TITLE IV

TRADE IN SERVICES

Article IV.1 Scope and Coverage

- The Parties, reaffirming their respective rights and obligations under the WTO General Agreement on Trade in Services (GATS), hereby lay down the necessary arrangements for progressive reciprocal liberalisation of trade in services.

- This Title shall apply to measures by the Parties affecting trade in services.

- This Title shall not apply to:

- in respect of air transport services, measures affecting traffic rights, however granted; or to measures affecting services directly related to the exercise of traffic rights, other than measures affecting:

- aircraft repair and maintenance services;

- the selling and marketing of air transport services;

- computer reservation system (CRS) services;

- ground-handling services; and

- airport management services.

- national cabotage in maritime transport services;

- subsidies provided by a Party or a state enterprise thereof, including grants, government-supported loans, guarantees and insurance. The Parties shall review the issue of disciplines on subsidies related to trade in services in the context of the review of this Title with a view to incorporating any disciplines agreed under Article XV of the GATS.

- laws, regulations or requirements governing the procurement by governmental agencies of services purchased for governmental purposes and not with a view to commercial resale or with a view to use in the supply of services for commercial sale.

- the Parties’ respective social security systems.

- This Title shall not apply to services supplied in the exercise of governmental authority within the territory of each Party.

- Consistent with this Title, each Party retains the right to regulate and to introduce new regulations to meet legitimate policy objectives.

Article IV.2 Incorporation of Provisions from the GATS

Wherever a provision of this Title provides that a provision of the GATS is incorporated into and made part of this Title, the meaning of the terms used in the GATS provision shall be understood as follows:

- “Member” means Party;

- “Schedule” means a Schedule referred to in Article IV.15 and contained in Annex III and

- “Specific commitment” means a specific commitment in a Schedule referred to in Article IV.15.

Article IV.3 Definitions

For the purposes of this Title:

- “trade in services” is defined as the supply of a service through the following modes:

(i) from the territory of a Party into the territory of the other Party (mode 1);

(ii) in the territory of a Party to the service consumer of the other Party (mode 2);

(iii) by a service supplier of a Party, through commercial presence in the territory of the other Party (mode 3);

(iv) by a service supplier of a Party, through presence of natural persons in the territory of the other Party (mode 4).

- the term “service” includes any service in any sector except a service supplied in the exercise of governmental authority;

- the term “service supplied in the exercise of governmental authority” means any service which is supplied neither on a commercial basis nor in competition with one or more service suppliers,

- the term “supply of a service” includes the production, distribution, marketing, sale and delivery of a service;

- “service supplier” means any person that supplies a service[1];

- the term “service consumer” means any person that receives or uses a service;

- the term “sector” of a service means,

- with reference to a specific commitment, one or more, or all, subsectors of that service, as specified in a Party’s Schedule,

- otherwise, the whole of that service sector, including all of its subsectors;

- the term “service of the other Party” means a service which is supplied,

- from or in the territory of that other Party, or in the case of maritime transport, by a vessel registered under the laws of that other Party, or by a person of that other Party which supplies the service through the operation of a vessel and/or its use in whole or in part; or

- in the case of the supply of a service through commercial presence or through the presence of natural persons, by a service supplier of that other Party;

- the term “commercial presence” means any type of business or professional establishment, including through:

- the constitution, acquisition or maintenance of a juridical person; or

- the creation or maintenance of a branch or a representative office within the territory of a Party for the purposes of supplying a service;

- the term “person” means either a natural person or a juridical person of a Party;

- the term “natural person of a Party” means a national of Türkiye or of Ukraine, according to their respective legislations.

- the term “juridical person” means any legal entity duly constituted or otherwise organized under applicable law, whether for profit or otherwise, and whether privately-owned or governmentally-owned, including any corporation, trust, partnership, joint venture, sole proprietorship or association;

- the term “juridical person of the other Party” means a juridical person which is either;

- constituted or otherwise organized under the law of the other Party and is engaged in substantive business operations in the territory of that party; or

- in the case of the supply of a service through commercial presence, owned or controlled by:

(a) natural persons of the other Party; or

(b) juridical persons of the other Party identified under subparagraph (i);

- a juridical person is:

- “owned” by persons of a Party if more than 50 percent of the equity interest in it is beneficially owned by persons of that Party;

- “controlled” by persons of a Party if such persons have the power to name a majority of its directors or otherwise to legally direct its actions;

- “affiliated” with another person when it controls, or is controlled by, that other person; or when it and the other person are both controlled by the same person;

- the term “measure” means any measure by a Party, whether in the form of a law, regulation, rule, procedure, decision, administrative action or any other form;

- the term “measures by a Party” means any measure taken by:

- the central, regional or local government or authorities; and

- non-governmental bodies in the exercise of powers delegated by the central, regional or local government or authorities;

- the term “measures by the Parties affecting trade in services” include measures in respect of:

- the purchase, payment or use of a service;

- the access to and use of, in connection with the supply of a service, services which are required by the Parties to be offered to the public generally;

- the presence, including commercial presence, of persons of a Party for the supply of a service in the territory of the other Party;

- the term “monopoly supplier of a service” means any person, public or private, which in the relevant market of the territory of a Party is authorized or established formally or in effect by that Party as the sole supplier of that service;

- the term “direct taxes” comprise all taxes on total income, on total capital or on elements of income or of capital, including taxes on gains from the alienation of property, taxes on estates, inheritances and gifts, and taxes on the total amounts of wages or salaries paid by enterprises, as well as taxes on capital appreciation;

- the definitions contained in paragraph 6 of the GATS Annex on Air Transport Services shall apply for the purpose of this Agreement.

Article IV.4 Most-Favoured-Nation Treatment (MFN)

- Without prejudice to measures taken in accordance with Article VII of the GATS, and except as provided for in its List of MFN Exemptions contained in Annex III, a Party shall accord immediately and unconditionally, in respect of all measures covered by this title, to services and service suppliers of the other Party treatment no less favourable than the treatment it accords to like services and service suppliers of any non-party.

- Treatment granted under other agreements concluded by one of the Parties and notified under Article V or Article V bis of the GATS shall not be subject to paragraph 1.

- If a Party enters into an agreement of the type referred to in paragraph 2, it shall upon request from the other Party afford adequate opportunity to that Party to negotiate the benefits granted therein.

- The rights and obligations of the Parties in respect of advantages accorded to adjacent countries shall be governed by paragraph 3 of Article II of the GATS.

Article IV.5 Market Access

- With respect to market access through the modes of supply identified in Article IV.3(a), each Party shall accord services and service suppliers of the other Party treatment no less favourable than that provided for under the terms, limitations and conditions agreed and specified in its Schedule of Specific Commitments in Annex III[2].

- In sectors where market-access commitments are undertaken, the measures which a Party shall not maintain or adopt either on the basis of a regional subdivision or on the basis of its entire territory, unless otherwise specified in its Schedule of Specific Commitments in Annex III are defined as:

- limitations on the number of service suppliers whether in the form of numerical quotas, monopolies, exclusive service suppliers or the requirements of an economic needs test;

- limitations on the total value of service transactions or assets in the form of numerical quotas or the requirement of an economic needs test;

- limitations on the total number of service operations or on the total quantity of service output expressed in terms of designated numerical units in the form of quotas or the requirement of an economic needs test[3];

- limitations on the total number of natural persons that may be employed in a particular service sector or that a service supplier may employ and who are necessary for, and directly related to, the supply of a specific service in the form of numerical quotas or the requirement of an economic needs test;

- measures which restrict or require specific types of legal entity or joint venture through which a service supplier may supply a service; and

- limitations on the participation of foreign capital in terms of maximum percentage limit on foreign shareholding or the total value of individual or aggregate foreign investment.

Article IV.6 National Treatment

- In the sectors inscribed in its Schedule of Specific Commitments in Annex III, and subject to any conditions and qualifications set out therein, each Party shall accord to services and service suppliers of the other Party, in respect of all measures affecting the supply of services, treatment no less favourable than that it accords to its own like services and service suppliers[4].

- A Party may meet the requirement of paragraph 1 by according to services and service suppliers of the other Party, either formally identical treatment or formally different treatment to that it accords to its own like services and service suppliers.

- Formally identical or formally different treatment shall be considered to be less favourable if it modifies the conditions of competition in favour of services or service suppliers of the Party which accords such treatment compared to like services or service suppliers of the other Party.

Article IV.7 Additional Commitments

Additional commitments shall be governed by Article XVIII of the GATS, which is hereby incorporated into and made part of this Title.

Article IV.8 Domestic Regulation

- In sectors where specific commitments are undertaken, each Party shall ensure that all measures of general application affecting trade in services are administered in a reasonable, objective and impartial manner.

- Where authorisation is required by a Party for the supply of a service,

- the competent authorities of that Party shall make publicly available:

- the requirements, including any documentation required, for completing applications relating to the supply of services; and

- all the evaluation criteria and the reasonable period of time normally required to reach a decision concerning an application relating to supply of services.

- Upon request of the applicant, the competent authorities of the Party shall;

- inform the applicant whether the application is considered complete after receipt of an application;

- identify the additional information required to complete the application in the case of an incomplete application, and provide the opportunity to correct deficiencies within a reasonable timeframe;

- notify the applicant, without undue delay, of the status of the application; and

- make known in writing the reasons for the denial of authorisation in case of an unsuccessful application.

- Each Party’s competent authorities shall make an administrative decision on a completed application of a service supplier of the other Party relating to the supply of services within a reasonable time period which is made public in advance, and shall promptly notify the applicant of the decision. This time period may be extended where it is not possible for a decision to be made within the specified period due to the complexity of the issue. In such a case, the competent authority shall notify the applicant without undue delay and shall endeavor to make the decision within a reasonable period of time thereafter. In case of an incomplete application, the specified time period may be suspended by the competent authorities until all documentation is received.

- Each Party shall ensure that any authorisation fees[5] are commensurate with the costs incurred by the competent authorities and do not in themselves restrict the supply of the service.

- In sectors where specific commitments are undertaken, each party shall ensure that measures relating to qualification requirements and procedures, technical standards, and licensing requirements do not constitute unnecessary barriers to trade in services, while recognizing the right to regulate and to introduce new regulations on the supply of services in order to meet public policy objectives. Each Party shall ensure that such measures are:

- based on objective and transparent criteria, such as competence and the ability to supply the service;

- not more burdensome than necessary to ensure the quality of the service;

- in the case of licensing procedures, not in themselves a restriction on the supply of the service.

- a) In sectors in which a Party has undertaken specific commitments, pending the incorporation of the disciplines referred to in paragraph 10 of this Article, that Party shall not apply licensing and qualification requirements and technical standards that nullify or impair its obligations under this Agreement in a manner which:

- does not comply with the criteria outlined in subparagraphs 5(a), (b) or (c) of this Article; and

- could not reasonably have been expected of that Party at the time the specific commitments in those sectors were made.

b) In determining whether a Party is in conformity with the obligation under paragraph 6(a) of this Article, account shall be taken of international standards of relevant international organisations[6] applied by that Party.

- In sectors where specific commitments regarding professional services are undertaken, each Party shall provide for adequate procedures to verify the competence of professionals of the other Party.

- Each Party shall maintain or institute as soon as practicable judicial, arbitral or administrative tribunals or procedures which provide, at the request of an affected service supplier of the other Party, for the prompt review of, and where justified, appropriate remedies for, administrative decisions affecting trade in services. Where such procedures are not independent of the agency entrusted with the administrative decision concerned, the Party shall ensure that the procedures in fact provide for an objective and impartial review.

- The provisions of paragraph 8 shall not be construed to require a Party to institute such tribunals or procedures where this would be inconsistent with its constitutional structure or the nature of its legal system.

- The Parties shall jointly review the results of the negotiations on disciplines on domestic regulation, pursuant to Article VI.4 of GATS, with a view to their incorporation into this Agreement.

Article IV.9 Mutual Recognition

- Nothing in this Agreement shall prevent a Party from requiring that persons must possess the necessary qualifications and/or professional experience specified in the territory where the service is supplied, for the sector of activity concerned.

- The Parties shall encourage the relevant professional bodies in their respective territories to provide recommendations on mutual recognition to the Joint Committee, for the purpose of the fulfilment, in whole or in part, by service suppliers of the criteria applied by each Party for the authorisation, licensing, operation and certification of service suppliers and, in particular, professional services.

- On receipt of a recommendation referred to in the preceding paragraph, the Joint Committee shall, within a reasonable time, review the recommendation with a view to determine whether it is consistent with this Agreement.

- When, in conformity with the procedure set in paragraph 3, a recommendation referred to in paragraph 2 has been found to be consistent with this Agreement and there is a minimum level of correspondence between the relevant regulations of the Parties, the Parties shall, with a view to implement that recommendation, negotiate, through their competent authorities, an agreement on mutual recognition of requirements, qualifications, licences and other regulations.

- Any such agreement shall be in conformity with the relevant provisions of the WTO Agreement and, in particular, Article VII of GATS.

Article IV.10 Transparency and Disclosure of Confidential Information

The rights and obligations of the Parties in respect of transparency shall be governed by paragraphs 1 and 2 of Article III and by Article III bis of the GATS, which are hereby incorporated into and made part of this Title.

Article IV.11 Monopolies and Exclusive Service Suppliers

The rights and obligations of the Parties in respect of monopolies and exclusive service suppliers shall be governed by paragraphs 1, 2 and 5 of Article VIII of the GATS, which are hereby incorporated into and made part of this Title.

Article IV.12 Business Practices

The rights and obligations of the Parties in respect of business practices shall be governed by Article IX of the GATS, which is hereby incorporated into and made part of this Title.

Article IV.13 Payments and Transfers

- Except under the circumstances envisaged in Article IV.14 and the related Articles of this Agreement, a Party shall not apply restrictions on international transfers and payments for current transactions with the other Party.

- Nothing in this Title shall affect the rights and obligations of the Parties under the Articles of the Agreement of the International Monetary Fund (hereinafter referred to as the “IMF”), including the use of exchange actions which are in conformity with the Articles of the Agreement of the IMF, provided that a Party shall not impose restrictions on capital transactions inconsistently with its specific commitments regarding such transactions, except under Article IV.15 or at the request of the IMF.

Article IV.14 Restrictions to Safeguard the Balance of Payments

- In the event of serious balance-of-payments and external financial difficulties or threat thereof, a Party may adopt or maintain restrictions on trade in services on which it has undertaken specific commitments, including on payments or transfers for transactions related to such commitments. It is recognized that particular pressures on the balance of payments of a Party in the process of economic development or economic transition may necessitate the use of restrictions to ensure, inter alia, the maintenance of a level of financial reserves adequate for the implementation of its programme of economic development or economic transition.

- Any restrictive measure adopted or maintained under paragraph 1 shall be non-discriminatory and of limited duration and shall not go beyond what is necessary to remedy the balance of payments and external financial situation. They shall be in accordance with the Article XII of GATS. The Party maintaining or having adopted such restrictive measures, or any changes thereto, shall promptly notify them to the Joint Committee and present, as soon as possible, a time schedule for their removal.

Article IV.15 Schedules of Specific Commitments

- The specific commitments undertaken by each Party are set out in Annex III. This Annex which consists of the Schedules of Specific Commitments and the lists of Most-Favoured Nation Exemptions, shall form an integral part of this Agreement. With respect to sectors where such commitments are undertaken, each Schedule specifies:

- terms, limitations and conditions on market access;

- conditions and qualifications on national treatment;

- undertakings relating to additional commitments referred to in Article IV.7;

- where appropriate the time-frame for implementation of such commitments and the date of entry into force of such commitments.

- Measures inconsistent with both Article IV.5 and Article IV.6 shall be inscribed in the column relating to Article IV.5. In this case the inscription will be considered to provide a condition or qualification to Article IV.6 as well.

Article IV.16 Modification of Schedules

The Parties shall, upon written request by a Party, hold consultations to consider any modification or withdrawal of a specific commitment in the requesting Party’s Schedule of specific commitments. The consultations shall be held within three months after the requesting Party made its request. In the consultations, the Parties shall aim to ensure that a general level of mutually advantageous commitments no less favourable to trade than that provided for in the Schedule of specific commitments prior to such consultations is maintained. Modifications of Schedules are subject to the procedures set out in Article IX.4 and Article IX.8 .

Article IV.17 Review of Commitments

With the objective of further liberalization of trade in services between them, the Parties commit themselves to review every 3 years their Schedules of specific commitments and their Lists of MFN-exemptions. The first review shall take place not later than 3 years after the entry into force of this Agreement.

Article IV.18 Emergency Safeguard Measures

- The Parties note the ongoing multilateral negotiations pursuant to Article X of GATS on the question of emergency safeguard measures based on the principle of non-discrimination. Upon conclusion of such multilateral negotiations, the Parties shall conduct a review for the purpose of discussing appropriate amendments to this Agreement so as to incorporate the results of such multilateral negotiations.

- In the event that the implementation of this Agreement causes substantial adverse impact to a service sector of a Party before the conclusion of the multilateral negotiations referred to in paragraph 1 of this Article, the affected Party may request for consultations with the other Party for the purposes of discussing any measure with respect to the affected service sector. The consultations will take place in the Joint Committee referred to in Article IX.4 to determine whether substantial adverse impact has occurred due to the implementation of this Agreement and the procedures of instituting emergency safeguards measures. Any measure taken pursuant to this paragraph shall be mutually agreed by the Parties. The Parties shall take into account the circumstances of the particular case and give sympathetic consideration to the Party seeking to take a measure.

Article IV.19 Denial of Benefits

A Party may deny the benefits of this Agreement:

- to the supply of a service, if it establishes that the service is supplied from or in the territory of a non-Party;

- in the case of the supply of a maritime transport service, if it establishes that the service is supplied:

- by a vessel registered under the laws of a non-Party; and

- by a person of a non-Party which operates and/or uses the vessel in whole or in part.

- to a service supplier that is a juridical person, if it establishes that it is not a service supplier of the other Party.

Article IV.20 Annexes

The following Annexes form an integral part of this Title:

– Annex III (Schedules of Specific Commitments and Lists of MFN Exemptions);

– Annex IV (Financial Services);

– Annex V (Transport and Logistics Services);

– Annex VI (Movement of Natural Persons);

– Annex VII (Telecommunications Services).

TITLE V

FACILITATION OF COMMERCIAL PRESENCE

Article V.1 Objectives and Scope

1. The purpose of this Title is to encourage mutual investments, to ensure facilitation of procedures in order to facilitate activities through commercial presence and create a better environment for doing business in the territory of each Party.

2. This Title applies to the measures by a Party affecting activities through commercial presence in its territory of a person of the other Party.

3. Parties’ obligations under this Title shall apply to measures adopted or maintained by:

central, regional or local governments and authorities; and

non-governmental bodies in the exercise of powers delegated by central, regional or local governments or authorities.

4. Parties recognise the right to regulate, and to introduce new regulations in order to meet national policy objectives in a manner consistent with their obligations under this Agreement.

5. Nothing in this Title shall be construed to confer any rights for market access.

6. This Title shall not apply to government procurement and public concessions.

7. The implementation of this Title shall be in accordance with the respective laws and regulations of each Party.

Article V.2 Definitions

1. For the purposes of this Title;

- “applicant” means a person of a Party pursuing activities through commercial presence who applied for an authorization in the territory of the other Party,

- “authorization” means the permission to pursue activities through commercial presence, resulting from a procedure an applicant must adhere to in order to demonstrate compliance with the necessary requirements;

- “juridical person” means any legal entity duly constituted or otherwise organised under the applicable law, whether for profit or otherwise, and whether privately-owned or governmentally-owned, including any corporation, trust, partnership, joint venture, sole proprietorship or association;

- “commercial presence” means any type of business or professional establishment, including through the constitution, acquisition or maintenance of a juridical person, in the territory of a Party for the purpose of pursuing activities through commercial presence;

- “person pursuing activities through commercial presence” means a natural person of a Party who under the law of that Party is a national of that Party; or a juridical person of a Party that seeks to establish, is establishing or has established to pursue activities through commercial presence in the territory of the other Party.

- “activities through commercial presence” means establishment, acquisition, expansion, operation, management, maintenance, use, enjoyment and sale or other disposal of commercial presence in services and non-services sectors;

- “decision” means a decision to issue or refuse to issue authorization to pursue activities through commercial presence, which is applied by the competent authority of each of the Parties in accordance with its law.

Article V.3 Transparency and Predictability

1. Each Party shall ensure that laws, regulations, procedures, and other measures of general application as well as international agreements affecting commercial presence are promptly published or otherwise made available in a manner that enables interested persons and the other Party to become acquainted with them.

2. If a Party requires authorization for activities through commercial presence, the Party, shall promptly publish or otherwise make publicly available in writing the information necessary to comply with the requirements and procedures for obtaining, maintaining, amending and renewing such authorization. Such information shall include, inter alia, where it is possible:

- the requirements and procedures;

- contact information of relevant competent authorities;

- fees;

- technical standards;

- procedures for appeal or review of decisions concerning applications;

- procedures for monitoring or enforcing compliance with the terms and conditions of licenses or qualifications;

- opportunities for public involvement, such as through hearings or comments; and

- indicative timeframes for processing of an application.

3. Each Party shall ensure that laws it proposes to adopt in relation to matters falling within the scope of this Title are published in advance in electronic form.

4. Each Party shall endeavour to ensure that regulations it proposes to adopt in relation to matters falling within the scope of this Title are published in advance in electronic form.

Article V.4 Procedures

Submission of Applications

1. Each Party, to the extent practicable, shall endeavour to avoid requiring an applicant to approach more than one competent authority for each application in order to demonstrate compliance with authorization requirements.

2. To the extent practicable, the competent authorities of each Party, shall accept applications in electronic format under the same conditions of authenticity as paper submissions.

Application Timeframes

3. The competent authorities of each Party, shall, to the extent practicable, permit an applicant to submit an application at any time. Where specific time periods for applications exist, they shall be of reasonable length.

Acceptance of Copies

4. The competent authorities of each Party shall accept authenticated copies in place of original documents.

Processing of Applications

- 5. If a Party requires authorisation, it shall ensure that its competent authorities:

- to the extent practicable, provide an indicative timeframe for processing of an application;

- to the extent practicable, ascertain without undue delay the completeness of an application for processing under the Party’s domestic laws and regulations;

- at the request of the applicant, provide without undue delay information concerning the status of the application, if possible in electronic form;

- process an application which they consider complete under the Party’s domestic laws and regulations, as expeditiously as possible;

- inform the applicant of the final decision[7] in writing[8] without undue delay.

6. Each Party, shall ensure that an authorisation is granted when all the applicable requirements have been fulfilled and, once granted, enters into effect without undue delay in accordance with the terms and conditions specified therein.

7. The competent authorities of each Party shall, within a reasonable period of time after the receipt of an application which they consider incomplete, to the extent practicable:

- inform the applicant that its application is considered incomplete;

- identify the additional information required to complete the application or otherwise provide guidance on why the application is considered incomplete; and

- provide the applicant the opportunity to complete its application within a reasonable period of time or, if appropriate, to submit a new application.

8. If the competent authorities of each Party, reject an application, they shall inform the applicant, in writing, to the extent possible[9]:

- of the reasons for rejection of the application and, the procedures for resubmission of an application;

- of the timeframe and procedures for any available review or appeal against the decision.

9. Parties should not prevent an applicant from submitting another application solely on the basis of a previously rejected application.

Article V.5 Fees

Each Party shall ensure that authorization fees[10] are based on authority set out in a measure, reasonable and, to the extent practicable, commensurate with the costs incurred by the competent authorities, including those for supervision of activities through commercial presence.

Article V.6 Appeal and Review

1. Each Party, shall provide that a person of the other Party pursuing activities through commercial presence in its territory, to which the competent authority has issued a decision, has the right in its territory, in accordance with procedures provided by the domestic laws of that Party which issued the contested decision to:

- an administrative appeal to the competent authority that issued the decision or review by an administrative authority higher than or independent of the competent authority that issued the decision; and/or

- a judicial appeal or review of the decision.

2. Each Party shall ensure that its procedures for appeal or review are carried out in a non-discriminatory manner.

Article V.7 Independence and Impartiality

1. Each Party shall ensure that the procedures used by, and the related decisions of, the competent authorities are impartial with respect to all applicants.

2. The competent authorities should be operationally independent of, and not accountable to, any person pursuing activities through commercial presence, for which the authorisation is required.

Article V.8 Digitalization and Electronic Governance

Electronic Documents

1. Parties shall endeavour to reach the highest possible level of digitalization of procedures related to the implementation of this Title.

2. For the purposes of this Agreement, electronic documents and electronic signatures shall produce the same legal effects as those of paper documents and handwritten signatures, subject to the Party’s domestic laws and regulations on electronic documents and electronic signatures

Point of Single Contact

3. Each Party shall endeavour to constitute the Point of Single Contact (PSC) for the submission of documents required by the agencies or regulatory bodies involved in activities through commercial presence.

4. Documents uploaded through the PSC shall not be subsequently required by any agency or regulatory body by any other means, except in cases in which the authenticity of the electronic document cannot be established or ensured through electronic means alone.

5. The PSC website shall provide information regarding policy, laws and regulations relating to activities through commercial presence.

6. The PSC shall contain the information referred to in Article V.3 (2) of this Title.

7. The provisions regarding PSC shall be, to the extent practicable, implemented within 5 (five) years after the entry into force of this Agreement.

Article V.9 Movement of Business Persons

The provisions of the Annex on Movement of Natural Persons shall apply to the measures affecting business persons of a Party. For the purposes of this Article “business persons of a Party” means natural persons of a Party who engages or seeks to engage in the conduct of activities through commercial presence in the territory of the other Party.

Article V.10 Working Group on Facilitation of Activities through Commercial Presence

1. A Working Group on Facilitation of activities through commercial presence is hereby established.

2. The Working Group shall meet as needed but at least once a year for the purpose of affording Parties the opportunity to raise any matters related to the implementation of this Title or the furtherance of its objectives.

3. The Working Group shall carry out such responsibilities such as:

- monitoring the implementation of these provisions of this Title;

- discuss issues related to facilitation of activities through commercial presence;

- propose cooperation and facilitation agendas, which may include issues such as: transfer of funds, personnel mobility and logistical matters, among others;

- exchange experiences in facilitation of activities through commercial presence;

- discuss views and requests from persons pursuing activities through commercial presence and other relevant stakeholders, when applicable, on specific issues; and

- compile and disseminate international best practices.

TITLE VI

ELECTRONIC COMMERCE

Article VI.1 Objective

The Parties, recognising the economic growth and trade opportunities that electronic commerce provides, the importance of avoiding barriers to its use and development, and the need for measures that promote consumer confidence in electronic commerce, agree to promote the development of electronic commerce between them.

Article VI.2 Scope and Definitions

1. This Title shall apply to measures adopted or maintained by a Party affecting trade by electronic means.

2. For the purposes of this Title:

- “electronic authentication” means the process or act of verifying the identity of a Party to an electronic communication or transaction or ensuring the integrity of an electronic communication;

- “electronic signature” means data in electronic form that is in, affixed to, or logically associated with, an electronic document taking into consideration Parties’ national legislation, and that may be used to identify the signatory in relation to the electronic document and indicate the signatory’s approval of the information contained in the electronic document;

- “personal data” means any information about an identified or identifiable individual;

- “unsolicited commercial electronic message” means an electronic message, which is sent for commercial purposes to an electronic address without the consent of the recipient or despite the explicit rejection of the recipient, through telecommunications services, comprising at least electronic mail and, to the extent provided for under the domestic laws and regulations of each Parties, other types of messages.

Article VI.3 Supply of Services through Electronic Means

The Parties affirm that measures affecting the supply of a service delivered or performed electronically are subject to the obligations contained in the relevant provisions of Title IV (Trade in Services), which are subject to any limitations, conditions, qualifications or exceptions set out in Schedule of Specific Commitments in Annex III that are applicable to such obligations.

Article VI.4 Personal Data Protection

1. The Parties recognise the economic and social benefits of protecting the personal data of users of electronic commerce and the contribution that this makes to enhancing consumer confidence in electronic commerce.

2. To this end, each Party shall adopt or maintain a domestic legal framework that provides for the protection of the personal data of users of electronic commerce.